Dr. Octopus

Footballguy

Good luck with that.Stop being a doosh

Good luck with that.Stop being a doosh

I am 50. I bought my first house in 2000 when I was 27. I saved like crazy. I never ate out for lunch, brought it from home every day.I have no idea how old you are but when you were in your 20s you stayed home every weekend and saved all your money instead of hitting up the clubs, going out to eat, going to movies, spending money on new CDs, etc?I disagree.This was a laughable statementIs coffee the only thing I cited? Is $300k the cheapest house in America?Even if this were true, it would take your daughter 5 years of saving that $8 per day instead of spending it on coffee to save enough for a 5% downpayment on a $300k house.It's not that young people buy coffee.Context of what?Yes. This.My sister-in-law went through this with her son and his wife. Both college educated with decent jobs and they were saying they couldn't afford anything in their not very expensive area. Turns out $800/month in entertainment was non-negotiable. Which hey, their money, their choice, but it's a little rich to cry poverty when you're taking multiple vacations a year and eating out all the time.If people prioritize buying a house, it can still be done absolutely. Some places are harder to buy than others, of course. But don't tell me people in their 20's aren't commonly blowing $1k a month on frivolities. They are. Obviously they are, or we wouldn't have these consumer spending numbers staying where they are.

To be fair, I know older people who spend like drunken idiots too (got to have that new car every two years!). It seems like it might be a little worse with the younger crew, but I'd like to see data.

And I'll agree 100% with 'their money, their choices'. They prioritize vacationing & eating out & fancy coffees. That's fine. Nobody says they have to have the same priorities as their parents & grandparents did. But the context matters and is often overlooked.

There is much data that college and a home are significantly more out of reach for young people.

This is not disqualified because young people buy coffee

It's that young people buy coffee at exorbitant prices.

I buy coffee, every single day. But I pay cents per cup, rather than $8 per cup. My daughter feels no regret spending $8 every day at Starbucks.

ITS NOT THE COFFEE

Stop being a doosh and laughing at my posts. If you'd like to disagree, do so in a respectful manner. That or ignore me, whatever.

I'm saying people didn't spend on frivolities in past decades like they do now.

If you disagree, that's fine. Say so. Maybe even explain your thinking.

I would like to buy their 2 year old car, kthxgot to have that new car every two years!

Actually, I think that is likely. Those folks got a lot of the stimmy bucks and many stashed portions of it. The savings rate was at all time highs during the pandemic as I recall.drawing down savings, which is unlikely

Yes?I have no idea how old you are but when you were in your 20s you stayed home every weekend and saved all your money instead of hitting up the clubs, going out to eat, going to movies, spending money on new CDs, etc?

I'm just saying unlikely because they've probably already blown through their pandemic savings.Actually, I think that is likely. Those folks got a lot of the stimmy bucks and many stashed portions of it. The savings rate was at all time highs during the pandemic as I recall.drawing down savings, which is unlikely

Yep, this too. My parents were wealthy by any normal standard, and it was a big treat for us to go out for fast food after church. (To be fair, my dad had buy out my grandad's share of the farm, so they had good reasons for being tight, but still).

Going back further, I can tell you with near certainty my parents spent less on the things you cite than I did. They probably valued becoming homeowners even more than I did, and they made it happen as well. I don't think this dynamic among the generations is anything unusual either.

Yeah, talk about a misleading headline

The number of people describing the economy as "very good" just hit its highest levels in almost 3 years. (That being said it's remarkable how highly people rated the economy in 2019. We're nowhere close to those levels)

Very good = 7%

Very bad = 38%

Going out to eat when I was a kid was a trip to Nathan’s, Arby’s and pizza places. The “fancy” dinners were Sizzler or Friendlys.Yep, this too. My parents were wealthy by any normal standard, and it was a big treat for us to go out for fast food after church. (To be fair, my dad had buy out my grandad's share of the farm, so they had good reasons for being tight, but still).

Going back further, I can tell you with near certainty my parents spent less on the things you cite than I did. They probably valued becoming homeowners even more than I did, and they made it happen as well. I don't think this dynamic among the generations is anything unusual either.

I am 50. I bought my first house in 2000 when I was 27. I saved like crazy. I never ate out for lunch, brought it from home every day.I have no idea how old you are but when you were in your 20s you stayed home every weekend and saved all your money instead of hitting up the clubs, going out to eat, going to movies, spending money on new CDs, etc?I disagree.This was a laughable statementIs coffee the only thing I cited? Is $300k the cheapest house in America?Even if this were true, it would take your daughter 5 years of saving that $8 per day instead of spending it on coffee to save enough for a 5% downpayment on a $300k house.It's not that young people buy coffee.Context of what?Yes. This.My sister-in-law went through this with her son and his wife. Both college educated with decent jobs and they were saying they couldn't afford anything in their not very expensive area. Turns out $800/month in entertainment was non-negotiable. Which hey, their money, their choice, but it's a little rich to cry poverty when you're taking multiple vacations a year and eating out all the time.If people prioritize buying a house, it can still be done absolutely. Some places are harder to buy than others, of course. But don't tell me people in their 20's aren't commonly blowing $1k a month on frivolities. They are. Obviously they are, or we wouldn't have these consumer spending numbers staying where they are.

To be fair, I know older people who spend like drunken idiots too (got to have that new car every two years!). It seems like it might be a little worse with the younger crew, but I'd like to see data.

And I'll agree 100% with 'their money, their choices'. They prioritize vacationing & eating out & fancy coffees. That's fine. Nobody says they have to have the same priorities as their parents & grandparents did. But the context matters and is often overlooked.

There is much data that college and a home are significantly more out of reach for young people.

This is not disqualified because young people buy coffee

It's that young people buy coffee at exorbitant prices.

I buy coffee, every single day. But I pay cents per cup, rather than $8 per cup. My daughter feels no regret spending $8 every day at Starbucks.

ITS NOT THE COFFEE

Stop being a doosh and laughing at my posts. If you'd like to disagree, do so in a respectful manner. That or ignore me, whatever.

I'm saying people didn't spend on frivolities in past decades like they do now.

If you disagree, that's fine. Say so. Maybe even explain your thinking.

Of course I did stuff on weekends, etc. But my priority was to buy a house from the first day I got my first real job. I saved money. I didn't spend anywhere close to 30% of my net take home on partying/ordering food, etc. And most of my friends were similar. We wanted to be home owners, some of us made it happen. It may have taken 5 years, but so what? It's supposed to take some time.

Going back further, I can tell you with near certainty my parents spent less on the things you cite than I did. They probably valued becoming homeowners even more than I did, and they made it happen as well. I don't think this dynamic among the generations is anything unusual either.

If your experience was different, great. I'm glad you've lived that type of life.

Isn't it almost always negative for those folks or close to it? Maybe not during the pandemic but for years prior to it, I kept reading about how much debt people were accumulating.While not broken up by generation, Moody's Analytics had a chart in WSJ showing that the savings rate for those earning <$70K has been negative for the past five quarters.

That means that not only are lower wage earners spending more than saving, but racking up more debt (or drawing down savings, which is unlikely).

Well I mean the clubs and bars I frequented were filled to the brim with other 20 year olds so Id say you were both in the far minority. I moved out at 26.Yes?I have no idea how old you are but when you were in your 20s you stayed home every weekend and saved all your money instead of hitting up the clubs, going out to eat, going to movies, spending money on new CDs, etc?

I mean, sure we bought stuff. But we knew we wanted to get out of our apartment and move into a house sooner rather than later, and we've never missed not eating out or not going to clubs.

The savings rate for <$70K earners was positive from late 2018 until early 2022 (the chart only went back to 2018) before going negative. Peaked at between positive 10-15% early '21.Isn't it almost always negative for those folks or close to it? Maybe not during the pandemic but for years prior to it, I kept reading about how much debt people were accumulating.While not broken up by generation, Moody's Analytics had a chart in WSJ showing that the savings rate for those earning <$70K has been negative for the past five quarters.

That means that not only are lower wage earners spending more than saving, but racking up more debt (or drawing down savings, which is unlikely).

It's not that young people buy coffee.Context of what?Yes. This.My sister-in-law went through this with her son and his wife. Both college educated with decent jobs and they were saying they couldn't afford anything in their not very expensive area. Turns out $800/month in entertainment was non-negotiable. Which hey, their money, their choice, but it's a little rich to cry poverty when you're taking multiple vacations a year and eating out all the time.If people prioritize buying a house, it can still be done absolutely. Some places are harder to buy than others, of course. But don't tell me people in their 20's aren't commonly blowing $1k a month on frivolities. They are. Obviously they are, or we wouldn't have these consumer spending numbers staying where they are.

To be fair, I know older people who spend like drunken idiots too (got to have that new car every two years!). It seems like it might be a little worse with the younger crew, but I'd like to see data.

And I'll agree 100% with 'their money, their choices'. They prioritize vacationing & eating out & fancy coffees. That's fine. Nobody says they have to have the same priorities as their parents & grandparents did. But the context matters and is often overlooked.

There is much data that college and a home are significantly more out of reach for young people.

This is not disqualified because young people buy coffee

It's that young people buy coffee at exorbitant prices.

I buy coffee, every single day. But I pay cents per cup, rather than $8 per cup. My daughter feels no regret spending $8 every day at Starbucks.

TouchéEach day we stray further from the stench of urine and grease.

What are these? Coffee shops who don't care about coffee, they just want everyone to rent?Cannot wait until Dutch Bros hits the east coast

the other day i had to help disassemble a machine for the first time in a long time and for the rest of the night my hands smelled like lithium grease and it was pretty fantastic take that to the bank brochachosEach day we stray further from the stench of urine and grease.

What are these? Coffee shops who don't care about coffee, they just want everyone to rent?Cannot wait until Dutch Bros hits the east coast

That's surprising to hear. I wouldnt think that those earning <70k would have much to save after accounting for basic expenses like housing, food, student loans, child care, etc.The savings rate for <$70K earners was positive from late 2018 until early 2022 (the chart only went back to 2018) before going negative. Peaked at between positive 10-15% early '21.Isn't it almost always negative for those folks or close to it? Maybe not during the pandemic but for years prior to it, I kept reading about how much debt people were accumulating.While not broken up by generation, Moody's Analytics had a chart in WSJ showing that the savings rate for those earning <$70K has been negative for the past five quarters.

That means that not only are lower wage earners spending more than saving, but racking up more debt (or drawing down savings, which is unlikely).

I would post the chart but unfortunately its embedded in a sub-only video.

So lets turn this negative atmosphere into a positive here. Save money on Starbucks, crash an AA meeting!*Their actual coffee tastes like something you might find at an AA meeting.

Yes. Savings rates go up with income level but have been positive most of the time throughout history, averaging positive 4% for the lower 90% income class since 1913. Exception being the 2000's decade. This article is from 2014 but includes a Berkeley study with those figures.That's surprising to hear. I wouldnt think that those earning <70k would have much to save after accounting for basic expenses like housing, food, student loans, child care, etc.The savings rate for <$70K earners was positive from late 2018 until early 2022 (the chart only went back to 2018) before going negative. Peaked at between positive 10-15% early '21.Isn't it almost always negative for those folks or close to it? Maybe not during the pandemic but for years prior to it, I kept reading about how much debt people were accumulating.While not broken up by generation, Moody's Analytics had a chart in WSJ showing that the savings rate for those earning <$70K has been negative for the past five quarters.

That means that not only are lower wage earners spending more than saving, but racking up more debt (or drawing down savings, which is unlikely).

I would post the chart but unfortunately its embedded in a sub-only video.

Reused bacon grease/fatback.

So lets turn this negative atmosphere into a positive here. Save money on Starbucks, crash an AA meeting!*Their actual coffee tastes like something you might find at an AA meeting.

GM dropping the knowledge!

* - no disrespect intended to actual AA meetings that may be pursuing this thread

Reused bacon grease/fatback.

if you're not saving and cooking with your bacon grease, you're simply doing it wrong! If we have good grass-fed steaks with some fat to trim, I render that down for use as well.

I grew up upper-middle class, but we also had property and a barn where we raised chickens (layers and fryers) and turkeys. We had a food dehydrator and regularly dried fruits from U-Pick farms. We fished most of the summer, and my mom would can salmon to make salmon patties throughout the winter. It wasn't because we had to, but it was how both of my parents were raised so they just kept doing that. A few of those habits have stuck with me, but not sure any will filter down to my 20-year old kid.

Big issue in a lot of places. Pricing out all but the highest paid workers.We are talking about teenagers.....in high school, not adults in the work force.If they work 40 hours they take home about $450 then?I know right. These teenagers just standing there helping us geezers with the self checkout getting paid $16 bucks per hour.

You think this is a lot of money where, and for who?

So yeah a teenager working part time making 16 bucks an hour living at

home is fine.

An adult working 40 hours a week at that wage is in trouble. Unskilled workforce workers are in a heap of trouble.

In fact where I live it's becoming a crisis finding help in the restaurant industry because no one can afford the rents here.

It's out of control.

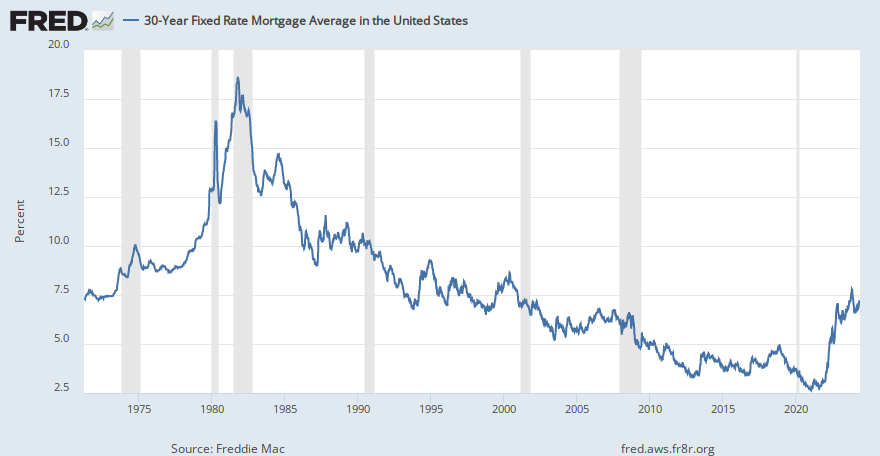

yeah, I’ve seen that chart. I mean…….something has to give in the housing market. Either rates come down and prices stay flat or rates remain steady and prices come down.…..or both rates and prices come down. Guess there are other scenarios but don’t see how those are sustainable long term.I've done zero digging into the quality of this data, but here's one analysis of median home price to median income in the U.S. since about 1945.

If the data is correct (and the sources seem good at cursory glance), present day is the highest price to income ratio in the entirety of the time range covered. I think there's legitimacy to the sentiment that it's tougher for average wage earners to afford a home purchase now than it has been in quite some time.

Think the most likely scenario imo is housing prices remain relatively flat and rates come down significantly.That chart is concerning.... so serious question - will the price of houses drop (like the bubble from before) - to hopefully even that out? Or is that too far gone at this point?

I'm not up on how the economy actually works

I'd think prices would be more likely to flatten out or drop if rates went up and/or other investments become more attractive. I don't know that national demand is drying up on its own.Think the most likely scenario imo is housing prices remain relatively flat and rates come down significantly.That chart is concerning.... so serious question - will the price of houses drop (like the bubble from before) - to hopefully even that out? Or is that too far gone at this point?

I'm not up on how the economy actually works

Think if rates drop, inventory will increase. A lot of people out there who would like to move but don’t want to go from a 3% rate to a 8% rate. 3% to 5% is a lot easier to stomach. Could definitely be wrong but if rates come down and prices go up, nothing has really changed and housing remains unaffordable for anyone looking to enter the market. That’s not a healthy housing market.I'd think prices would be more likely to flatten out or drop if rates went up and/or other investments become more attractive. I don't know that national demand is drying up on its own.Think the most likely scenario imo is housing prices remain relatively flat and rates come down significantly.That chart is concerning.... so serious question - will the price of houses drop (like the bubble from before) - to hopefully even that out? Or is that too far gone at this point?

I'm not up on how the economy actually works

There's some truth to the irresponsible spending habits of younger generations, but 'the why' does not get talked about enough. If home ownership and a family were affordable then we'd see spending habits that align with achieving those goals. Neither is, so we see spending habits that align with alternative goals.I've done zero digging into the quality of this data, but here's one analysis of median home price to median income in the U.S. since about 1945.

If the data is correct (and the sources seem good at cursory glance), present day is the highest price to income ratio in the entirety of the time range covered. I think there's legitimacy to the sentiment that it's tougher for average wage earners to afford a home purchase now than it has been in quite some time.

All those people waiting to move are going to buy a new house wherever they're going, I don't think it will ease pricing. The volume would increase, but easy money is how we got to these prices in the first place. I doubt it would be different if rates went down again.Think if rates drop, inventory will increase. A lot of people out there who would like to move but don’t want to go from a 3% rate to a 8% rate. 3% to 5% is a lot easier to stomach. Could definitely be wrong but if rates come down and prices go up, nothing has really changed and housing remains unaffordable for anyone looking to enter the market. That’s not a healthy housing market.I'd think prices would be more likely to flatten out or drop if rates went up and/or other investments become more attractive. I don't know that national demand is drying up on its own.Think the most likely scenario imo is housing prices remain relatively flat and rates come down significantly.That chart is concerning.... so serious question - will the price of houses drop (like the bubble from before) - to hopefully even that out? Or is that too far gone at this point?

I'm not up on how the economy actually works

It's not just higher interest rates but chronic lack of supply.All those people waiting to move are going to buy a new house wherever they're going, I don't think it will ease pricing. The volume would increase, but easy money is how we got to these prices in the first place. I doubt it would be different if rates went down again.Think if rates drop, inventory will increase. A lot of people out there who would like to move but don’t want to go from a 3% rate to a 8% rate. 3% to 5% is a lot easier to stomach. Could definitely be wrong but if rates come down and prices go up, nothing has really changed and housing remains unaffordable for anyone looking to enter the market. That’s not a healthy housing market.I'd think prices would be more likely to flatten out or drop if rates went up and/or other investments become more attractive. I don't know that national demand is drying up on its own.Think the most likely scenario imo is housing prices remain relatively flat and rates come down significantly.That chart is concerning.... so serious question - will the price of houses drop (like the bubble from before) - to hopefully even that out? Or is that too far gone at this point?

I'm not up on how the economy actually works

It'd be good to hear from some of the resident real estate guys on this.

Right, increase in new inventory would help reduce prices. But more old stuff coming on the market due to lower rates isn't going to take much of the edge off, it'd just be a feeding frenzy that'd support or raise existing prices.It's not just higher interest rates but chronic lack of supply.All those people waiting to move are going to buy a new house wherever they're going, I don't think it will ease pricing. The volume would increase, but easy money is how we got to these prices in the first place. I doubt it would be different if rates went down again.Think if rates drop, inventory will increase. A lot of people out there who would like to move but don’t want to go from a 3% rate to a 8% rate. 3% to 5% is a lot easier to stomach. Could definitely be wrong but if rates come down and prices go up, nothing has really changed and housing remains unaffordable for anyone looking to enter the market. That’s not a healthy housing market.I'd think prices would be more likely to flatten out or drop if rates went up and/or other investments become more attractive. I don't know that national demand is drying up on its own.Think the most likely scenario imo is housing prices remain relatively flat and rates come down significantly.That chart is concerning.... so serious question - will the price of houses drop (like the bubble from before) - to hopefully even that out? Or is that too far gone at this point?

I'm not up on how the economy actually works

It'd be good to hear from some of the resident real estate guys on this.

Annual housing starts completely plummeted during the Great Recession, and then took the entire 2010's decade just to get back to historical norms, only to fall drastically again during the pandemic.

Even now annual new builds are still well below the 1990-2006 annual levels.

Federal Reserve database - new SF housing starts

yeah, I’ve seen that chart. I mean…….something has to give in the housing market. Either rates come down and prices stay flat or rates remain steady and prices come down.…..or both rates and prices come down. Guess there are other scenarios but don’t see how those are sustainable long term.

Don't disagree...unless perhaps the lower rates are due to a hard-landing recession that results in a significant number of forced sales.Right, increase in new inventory would help reduce prices. But more old stuff coming on the market due to lower rates isn't going to take much of the edge off, it'd just be a feeding frenzy that'd support or raise existing prices.It's not just higher interest rates but chronic lack of supply.

Annual housing starts completely plummeted during the Great Recession, and then took the entire 2010's decade just to get back to historical norms, only to fall drastically again during the pandemic.

Even now annual new builds are still well below the 1990-2006 annual levels.

Federal Reserve database - new SF housing starts

Indeed, a recession would probably lower prices - but then people will have less money to buy them. I wonder what that would do to the price/income ratio.Don't disagree...unless perhaps the lower rates are due to a hard-landing recession that results in a significant number of forced sales.Right, increase in new inventory would help reduce prices. But more old stuff coming on the market due to lower rates isn't going to take much of the edge off, it'd just be a feeding frenzy that'd support or raise existing prices.It's not just higher interest rates but chronic lack of supply.

Annual housing starts completely plummeted during the Great Recession, and then took the entire 2010's decade just to get back to historical norms, only to fall drastically again during the pandemic.

Even now annual new builds are still well below the 1990-2006 annual levels.

Federal Reserve database - new SF housing starts

Right, increase in new inventory would help reduce prices. But more old stuff coming on the market due to lower rates isn't going to take much of the edge off, it'd just be a feeding frenzy that'd support or raise existing prices.It's not just higher interest rates but chronic lack of supply.All those people waiting to move are going to buy a new house wherever they're going, I don't think it will ease pricing. The volume would increase, but easy money is how we got to these prices in the first place. I doubt it would be different if rates went down again.Think if rates drop, inventory will increase. A lot of people out there who would like to move but don’t want to go from a 3% rate to a 8% rate. 3% to 5% is a lot easier to stomach. Could definitely be wrong but if rates come down and prices go up, nothing has really changed and housing remains unaffordable for anyone looking to enter the market. That’s not a healthy housing market.I'd think prices would be more likely to flatten out or drop if rates went up and/or other investments become more attractive. I don't know that national demand is drying up on its own.Think the most likely scenario imo is housing prices remain relatively flat and rates come down significantly.That chart is concerning.... so serious question - will the price of houses drop (like the bubble from before) - to hopefully even that out? Or is that too far gone at this point?

I'm not up on how the economy actually works

It'd be good to hear from some of the resident real estate guys on this.

Annual housing starts completely plummeted during the Great Recession, and then took the entire 2010's decade just to get back to historical norms, only to fall drastically again during the pandemic.

Even now annual new builds are still well below the 1990-2006 annual levels.

Federal Reserve database - new SF housing starts

This was prudent, though. The pandemic was a once-in-a-lifetime genuine economic emergency. We got interest dates down to basically zero and absolutely flooded the economy with money through expansionary fiscal policy, and that was a sound course of action to keep the economy running while everything was either shut down or scrambled due to poor supply chains. And when the pandemic was behind us and inflation picked up, the Fed did what it needed to do and raised rates. This was mostly predictable.Yep, housing market is in a pickle. It was already on fire due to (some would argue politically motivated) low rates and chronic underbuilding. The Fed poured napalm on the fire due to cutting rates so drastically and leaving them too low for too long due to COVID. They’ve massively slammed on the brakes the past year and a half or so.

While cheaper, townhouses are still really expensive. Looking at 500k-600k for a 3br in nj. It is new construction after all which will always be at a premium.Maybe more than a few towns can re-zone all this land they have earmarked for single family homes that young people can afford, and some affordable townhouses can go up.

This was prudent, though. The pandemic was a once-in-a-lifetime genuine economic emergency. We got interest dates down to basically zero and absolutely flooded the economy with money through expansionary fiscal policy, and that was a sound course of action to keep the economy running while everything was either shut down or scrambled due to poor supply chains. And when the pandemic was behind us and inflation picked up, the Fed did what it needed to do and raised rates. This was mostly predictable.Yep, housing market is in a pickle. It was already on fire due to (some would argue politically motivated) low rates and chronic underbuilding. The Fed poured napalm on the fire due to cutting rates so drastically and leaving them too low for too long due to COVID. They’ve massively slammed on the brakes the past year and a half or so.

The after-effects suck, and like I said before, I really don't blame young adults for feeling hard done by. But it would have been irresponsible for the Fed to just sit there during the pandemic, and it also would have been irresponsible for the Fed to just there when inflation was was surging. They've done well under the circumstances IMO.

This was prudent, though. The pandemic was a once-in-a-lifetime genuine economic emergency. We got interest dates down to basically zero and absolutely flooded the economy with money through expansionary fiscal policy, and that was a sound course of action to keep the economy running while everything was either shut down or scrambled due to poor supply chains. And when the pandemic was behind us and inflation picked up, the Fed did what it needed to do and raised rates. This was mostly predictable.Yep, housing market is in a pickle. It was already on fire due to (some would argue politically motivated) low rates and chronic underbuilding. The Fed poured napalm on the fire due to cutting rates so drastically and leaving them too low for too long due to COVID. They’ve massively slammed on the brakes the past year and a half or so.

The after-effects suck, and like I said before, I really don't blame young adults for feeling hard done by. But it would have been irresponsible for the Fed to just sit there during the pandemic, and it also would have been irresponsible for the Fed to just there when inflation was was surging. They've done well under the circumstances IMO.

Well @Buckna and I basically said the same thing but he said it much better and without using the word "stimulus" ever 3 words like I just noticed I did when re-reading my post.